Crypto Markets Experience Turbulence Amid Spot ETH ETF Decision, $350M Liquidations Follow

Quick Take:

- Crypto prices undergo significant fluctuations as traders await regulatory decision on spot-based Ethereum ETFs.

- ETH experiences dramatic swings, dropping to $3,500 before surging to nearly $3,900 following reports of ETF approval.

- Bitcoin also sees volatile movement, dropping to the low-$66,000s and then spiking to $68,300.

- Liquidations across leveraged crypto derivatives surpass $350 million, with long positions bearing the brunt.

Crypto markets were thrown into chaos on Thursday as traders eagerly anticipated a crucial U.S. regulatory verdict regarding the listing of spot-based Ethereum exchange-traded funds (ETFs). During the nail-biting hours preceding the eventual decision, the price of ETH experienced a rollercoaster ride, plummeting to $3,500 around the time of the traditional U.S. market close, only to surge to nearly $3,900 as initial reports hinted at approval. Ultimately, Ethereum settled above $3,800 after the confirmation, showcasing its resilience amid the tumultuous market conditions.

Meanwhile, Bitcoin (BTC) witnessed a similarly turbulent episode, with its price sinking to the low-$66,000s before abruptly spiking to $68,300. However, the gains were short-lived as BTC retraced below the $68,000 mark. Despite the volatility, Ethereum displayed relative strength, recording a 1.5% increase over the past 24 hours, while Bitcoin experienced a decline of almost 3% during the same period. The broader market, as indicated by the CoinDesk 20 Index, saw a 1.6% downturn throughout the day.

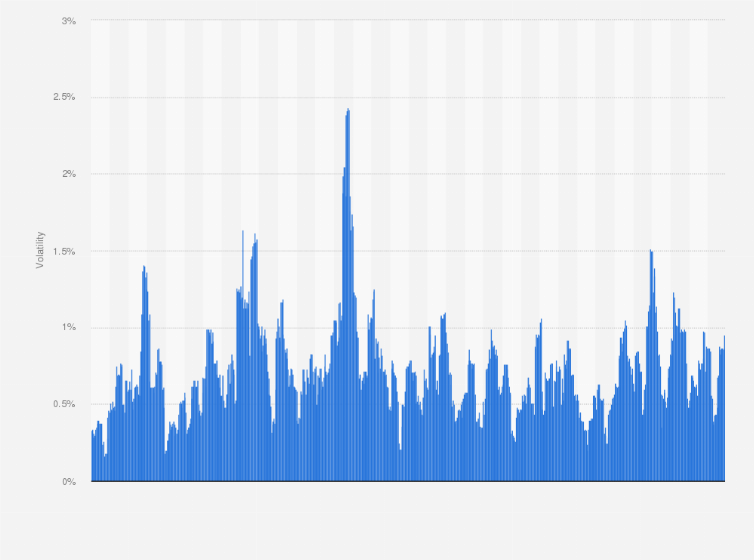

Amidst the frenzied market activity, liquidations across all leveraged crypto derivative positions surged to over $350 million, marking the highest figure since May 1, according to data from CoinGlass. Liquidations occur when exchanges forcibly close leveraged trading positions due to insufficient margin or inability to meet margin requirements, resulting in a partial or total loss of the trader’s initial investment.

The majority of the liquidated positions were long bets on rising prices, amounting to approximately $250 million. This suggests that many traders, overextended with leverage, were caught off-guard by the sudden downward price movement. Among the liquidated assets, ETH derivatives bore the brunt, accounting for $132 million in liquidations, followed by $70 million in BTC derivatives.