U.S. House Approves Bill to Ban Federal Reserve from Issuing a CBDC

QUICK TAKE

- The U.S. House of Representatives has passed a bill preventing the Federal Reserve from issuing a central bank digital currency (CBDC).

- The bill, named the CBDC Anti-Surveillance State Act, was introduced by Majority Whip Tom Emmer (R-Minn.).

- Republicans voiced concerns that a U.S. CBDC could lead to governmental control over citizens.

- Democrats argued that such fears are exaggerated and that the bill would hinder public sector innovation.

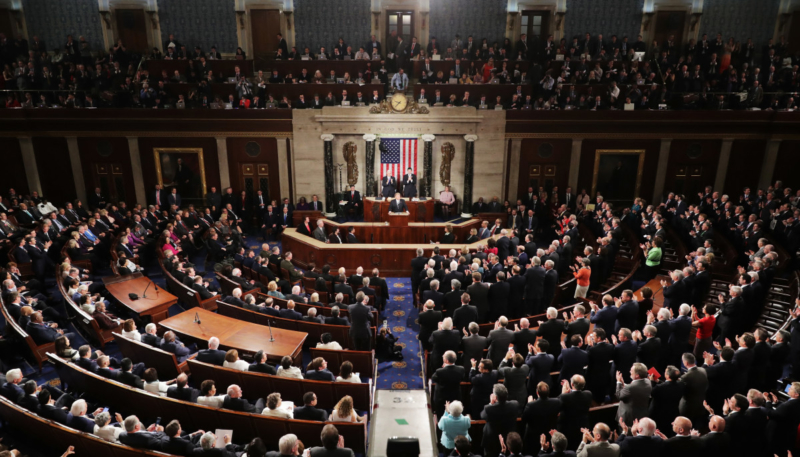

In a significant move, the U.S. House of Representatives has passed the CBDC Anti-Surveillance State Act, a bill aimed at preventing the Federal Reserve from developing a central bank digital currency (CBDC). This decision, largely split along party lines, reflects a deep division in perspectives regarding the potential implications of a digital dollar.

The CBDC Anti-Surveillance State Act

Introduced by Majority Whip Tom Emmer (R-Minn.), the bill aims to halt any progress by the U.S. central bank toward the creation of a CBDC. Emmer and other Republicans argue that a CBDC could be used by the government to monitor and control American citizens. This fear of government overreach and surveillance is a central theme among the bill’s supporters. They believe that a CBDC could pave the way for unprecedented governmental control over financial transactions and, by extension, individual freedoms.

Opposition and Debate

On the other side of the aisle, Democrats have dismissed these concerns as unfounded and exaggerated. During the debate preceding Thursday’s vote, Democratic representatives argued that banning the development of a CBDC would stifle innovation and prevent valuable research in the public sector. They stressed the importance of exploring new financial technologies to maintain the U.S.’s competitive edge in the global financial landscape.

Despite the heated debate, the bill passed with 213 Republicans and three Democrats voting in favor, while 192 Democrats opposed it. This outcome highlights the stark partisan divide on the issue of digital currency and governmental oversight.

Context and Comparison

The vote on the CBDC Anti-Surveillance State Act comes on the heels of another significant vote in the House. Just a day before, 71 Democrats joined 208 Republicans to pass the Financial Innovation and Technology for the 21st Century Act (FIT21). This crypto market structure bill aims to grant the U.S. Commodity Futures Trading Commission (CFTC) greater authority over the spot market for digital assets and clarify the Securities and Exchange Commission’s (SEC) role in regulating the sector.

Industry participants have hailed the passage of FIT21 as a monumental step forward for the crypto industry in the U.S. Kristin Smith, the head of the Blockchain Association, described it as a “watershed moment” and a “badge of Congressional validation” for the sector. Similarly, Nicole Valentine, director of FinTech at the Milken Institute, praised the vote as a “welcome step” toward regulatory clarity.

Uncertain Future in the Senate

However, despite these advances in the House, both the CBDC Anti-Surveillance State Act and the FIT21 bill face uncertain futures in the Senate. There is no corresponding legislation in the other chamber for either bill, raising doubts about their prospects of becoming law. This legislative gridlock reflects broader challenges in achieving consensus on how to regulate emerging financial technologies and digital assets.

The debate over the CBDC Anti-Surveillance State Act underscores the broader ideological clash over the role of government in regulating digital currencies. While proponents see the bill as a necessary safeguard against governmental overreach, opponents warn that it could hinder innovation and leave the U.S. lagging in the global race for financial technology leadership.

In conclusion, the passage of the CBDC Anti-Surveillance State Act in the House marks a pivotal moment in the ongoing debate over digital currency regulation. As the bill moves to the Senate, its fate remains uncertain, reflecting the complex and often contentious nature of policymaking in the rapidly evolving world of digital finance. Whether or not the Senate acts on this bill, the discussion it has sparked will likely continue to shape the future of digital currency regulation in the United States.