Coinbase Shares Plummet 9% Following CME’s Potential Spot Bitcoin Trading Announcement

QUICK TAKE

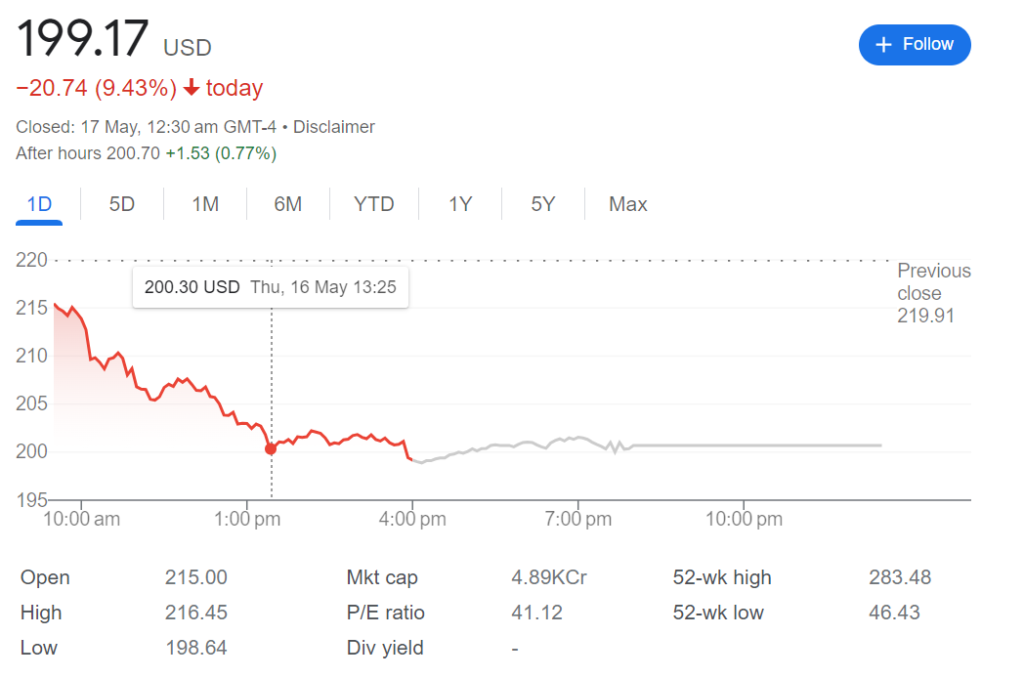

- Coinbase Shares Drop: Shares of Coinbase fell nearly 8% to $202.49 following the news.

- CME’s Plans: The Chicago Mercantile Exchange (CME) is reportedly considering offering spot bitcoin trading.

- Impact on Crypto Market: Despite the drop in Coinbase shares, cryptocurrencies experienced an uptick with Bitcoin gaining half a percent.

Coinbase Shares Sink Amid CME Spot Bitcoin Trading Speculation

Shares of Coinbase dropped nearly 8% on Thursday to $202.49 following a report from the Financial Times that the Chicago Mercantile Exchange (CME) might soon offer spot bitcoin trading. This development poses a significant challenge to Coinbase, which has enjoyed a strong position as the most trusted crypto exchange in the U.S.

The drop in Coinbase shares came amid a broader upward trend in the cryptocurrency market. The CoinDesk 20 Index, which tracks the 20 largest digital tokens by market capitalization, rose 0.91% in the past 24 hours. Bitcoin, the largest cryptocurrency by market cap, saw a modest increase of half a percent, continuing its rally driven by better-than-expected inflation data reported on Wednesday.

CME’s Strategic Move

The Chicago-based CME, renowned as the largest futures exchange globally, is exploring the potential for offering spot bitcoin trading. According to the Financial Times, CME has been in discussions with traders interested in trading bitcoin on a regulated platform. This move comes as the CME already holds the title of the largest bitcoin futures exchange by open interest in the U.S., positioning it as a major player in the digital asset market.

Market Reactions and Implications

The news of CME’s potential entry into spot bitcoin trading has significant implications for the crypto market. Coinbase, which has been a dominant force in the U.S. crypto exchange landscape, faces a new and formidable competitor. CME’s designation as a “systemically important financial market utility” by U.S. regulators means it operates under stricter supervision, adding a layer of trust for investors wary of crypto exchanges due to past incidents like the collapse of FTX.

Institutional and Retail Interest

The introduction of spot bitcoin trading by CME could attract both institutional and retail investors who seek a more regulated and secure trading environment. Recently launched spot bitcoin exchange-traded funds (ETFs) have already demonstrated substantial interest from traders. Within the first three months of their launch, over 500 institutions allocated more than $10 billion to these funds, with retail traders contributing an additional $40 billion.

Coinbase’s Position and Future Prospects

While Coinbase’s stock has experienced a significant drop, it remains up 29% year-to-date, reflecting the overall positive trend in crypto prices since the beginning of the year. However, the potential competition from CME could alter the dynamics of the crypto exchange market. Coinbase has benefited from its reputation as a reliable platform, but CME’s established trust and regulatory backing could sway investors.

Broader Market Dynamics

Despite the dip in Coinbase shares, the overall cryptocurrency market remains buoyant. The positive momentum driven by favorable economic indicators continues to support digital asset prices. As the market evolves, the introduction of more regulated trading options like those potentially offered by CME could enhance investor confidence and drive further growth in the crypto sector.

Conclusion

The news of CME’s potential entry into spot bitcoin trading marks a pivotal moment for the cryptocurrency market. While Coinbase faces immediate challenges reflected in its stock price drop, the broader market sentiment remains optimistic. The increased regulatory oversight and trust associated with CME’s involvement could attract a wider range of investors, ultimately contributing to the maturation and stability of the crypto market. As the situation develops, it will be crucial to monitor how these dynamics influence both established players like Coinbase and the broader digital asset ecosystem.