Bitcoin Gains Momentum Ahead of US Inflation Data

QUICK TAKE

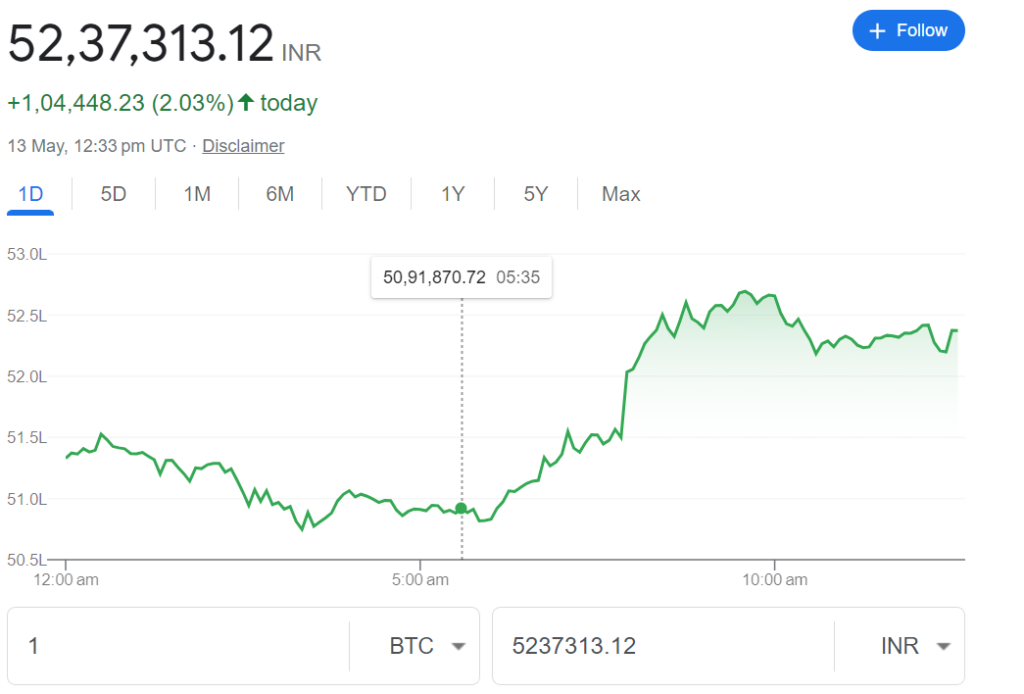

- Bitcoin shows upward movement as traders await US inflation data.

- The Federal Reserve’s response to inflation could impact market sentiment and Bitcoin’s trajectory.

Bitcoin exhibited a positive trend on Monday morning, with traders eagerly anticipating forthcoming United States inflation data. This data holds significant weight as it could influence decisions regarding the Federal Reserve’s monetary policy adjustments in 2024.

The leading cryptocurrency, by market capitalization, maintained its position above the $62,000 mark. Within the past 24 hours, it recorded nearly a 3% increase, trading at $62,815 as of 5:02 a.m. ET, according to data from The Block’s Price Page. Recent economic indicators from the US have indicated a mild deceleration in economic activity compared to the robust conditions observed in 2023. April’s employment figures fell below analysts’ expectations for the first time in several months, signaling a potential need for the Federal Reserve to consider rate cuts to mitigate the risk of a significant economic slowdown.

Investors are eagerly awaiting confirmation regarding the persistence of inflation, as this data could provide valuable insights into the likelihood, timing, and extent of potential rate cuts in the current year. This week, the market anticipates crucial US inflation readings, starting with the Producer Price Index (PPI) on Tuesday, followed by the Consumer Price Index (CPI) on Wednesday.

According to the CME’s FedWatch tool, there is a 24.6% probability of a rate cut at July’s Federal Open Market Committee (FOMC) meeting and a 48.6% probability at September’s meeting. Interest traders are predicting a 96.5% chance that rates will remain unchanged at June’s meeting.

Market analysts from QCP Capital highlighted that unless the Federal Reserve explicitly dismisses the possibility of rate cuts or hints at rate hikes, market sentiment is likely to lean towards expectations of rate cuts, maintaining a bullish tone in the market for the foreseeable future.