Fidelity’s Bold Prediction: Bitcoin Primed for a Remarkable Surge as Volatility Hits Historic Lows

Quick Take:

- Fidelity Investments anticipates Bitcoin’s volatility, at its lowest in years, heralding a potential surge.

- Analysts foresee significant value appreciation with little signs of trading frenzy.

- Market data suggests Bitcoin’s evolution towards a mature asset, akin to gold.

In the ever-fluctuating realm of cryptocurrencies, Bitcoin stands as a beacon of resilience and volatility. Yet, according to Fidelity Investments, a paradigm shift might be imminent. As Bitcoin’s volatility plunges to unprecedented lows, industry analysts are poised for a seismic upward movement in its value.

Traditionally viewed as a high-risk investment, Bitcoin’s volatility is far from static. It oscillates, mirroring market sentiment and investor behavior. Over the past year, despite reaching dizzying price peaks, Bitcoin’s volatility has plummeted to historic lows, hinting at a potential bull run on the horizon.

Zack Wainwright, a research analyst at Fidelity Investments, underscored this phenomenon in a recent report. He suggests that Bitcoin’s subdued volatility could pave the way for substantial price appreciation, especially in the absence of rampant trading mania.

Historical data corroborates this theory, as Wainwright highlights. Instances where Bitcoin revisits and surpasses all-time price highs often precede significant price surges. Such moments catalyze investor interest and drive prices upwards, propelling Bitcoin into uncharted territory.

However, Wainwright cautions against drawing parallels with the tumultuous 2021 bull market. He notes that unforeseen global events, such as the COVID-19 pandemic, can disrupt market trajectories, impacting Bitcoin’s performance.

Interestingly, Bitcoin’s current volatility levels rival those of established tech giants like Nvidia, Tesla, and Meta Platforms. This suggests a maturation process underway, positioning Bitcoin as a more stable investment option.

Comparisons with gold further accentuate Bitcoin’s evolution. Despite its infancy compared to the millennia-old precious metal, Bitcoin demonstrates similar patterns of volatility reduction as it gains recognition as an asset class.

Drawing parallels with gold, Wainwright elucidates that as markets settle on long-term price ranges, volatility naturally diminishes. Bitcoin, on its trajectory towards mainstream acceptance, mirrors this pattern, exemplifying its growing stature in the investment landscape.

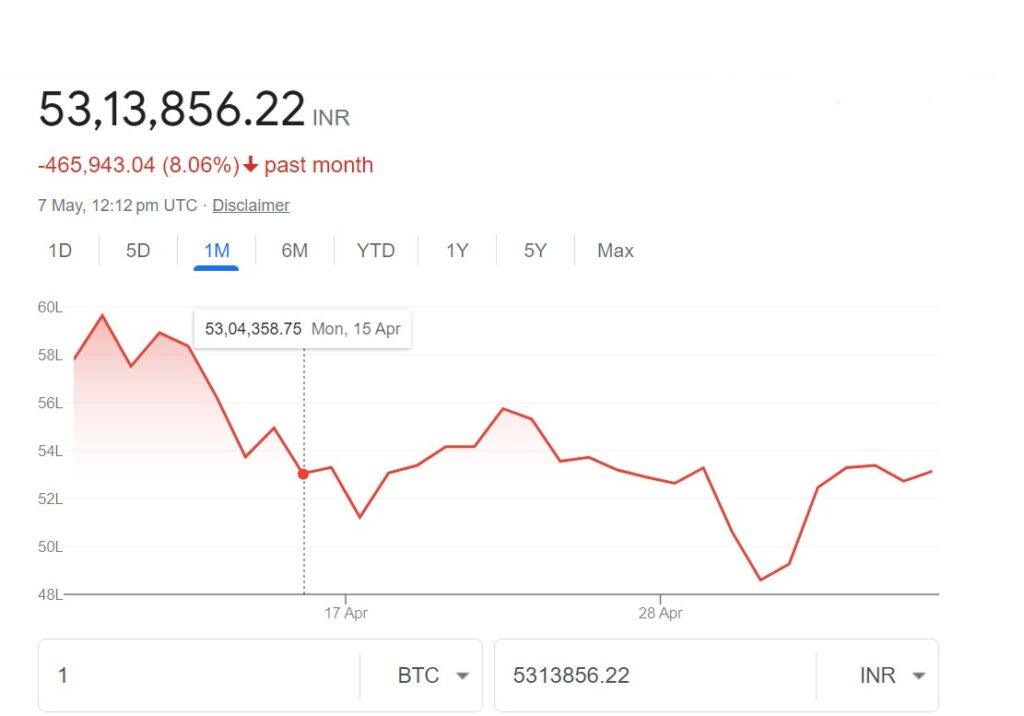

In light of these insights, market observers eagerly await Bitcoin’s next move. At present, Bitcoin hovers around the $63,600 mark, showcasing marginal fluctuations over the past 24 hours. Ethereum, its closest contender, registers a slight dip, trading just above $3,000.

As the crypto market braces for potential upheavals, Fidelity’s prognosis offers a glimmer of hope for Bitcoin enthusiasts. With volatility at historic lows, the stage seems set for Bitcoin to reclaim its mantle as the reigning champion of cryptocurrencies.