Biden Administration’s Crypto Stance Softening, Says Kraken CEO

QUICK TAKE:

- Kraken CEO Dave Ripley sees a shift in the Biden Administration’s crypto stance.

- Ripley highlights the successful passage of the Financial Innovation and Technology for the 21st Century Act (FIT21) in the House.

- Former President Trump’s evolving views on cryptocurrency are also discussed.

Biden Administration’s Crypto Stance Softening, Says Kraken CEO

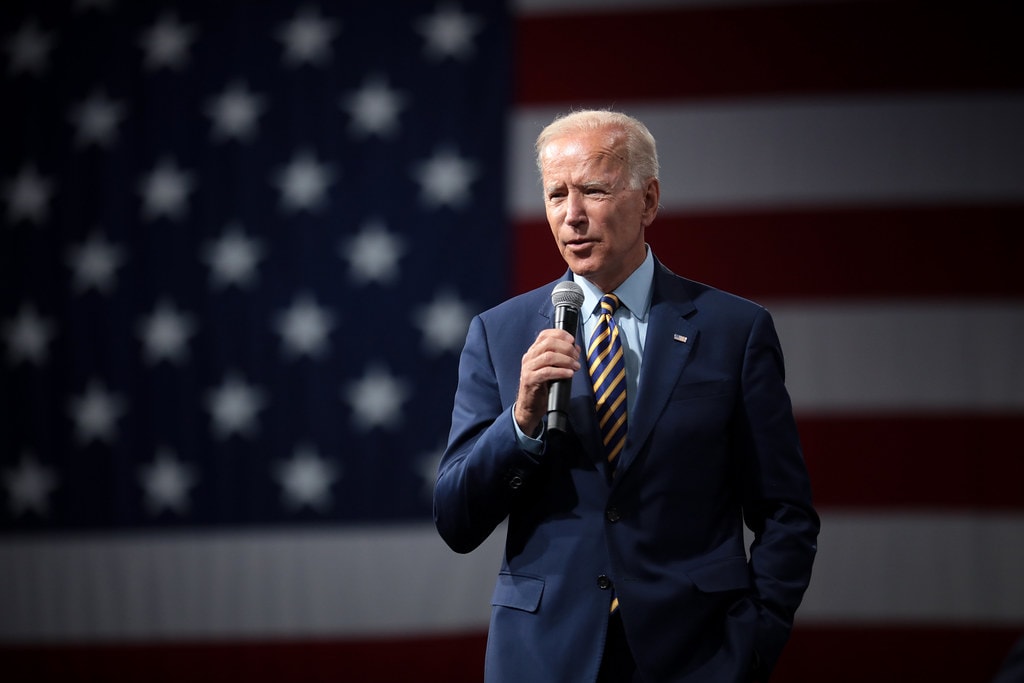

In a recent interview with CNBC, Kraken CEO Dave Ripley shared his insights on the Biden Administration’s changing attitude toward cryptocurrencies. According to Ripley, there has been a noticeable shift from the previously strong negative stance, primarily driven by the Securities and Exchange Commission (SEC), to a more supportive approach within the government.

“When we entered this year, the executive branch, particularly through the SEC, was quite hostile towards cryptocurrencies,” Ripley explained during the interview on CNBC’s “Squawk Box” with Joe Kernan. “However, I’ve noticed significant support within the U.S. government. During my visits to D.C., I’ve engaged with various members of Congress and the Senate who are supportive of crypto. Over the past few months, we’ve observed growing and now bipartisan support.”

Ripley also pointed to the Financial Innovation and Technology for the 21st Century Act (FIT21) as a key indicator of this shift. The bill, designed to create a comprehensive regulatory framework for the cryptocurrency industry, passed the House with a significant majority of 279-136 on May 22.

“We didn’t anticipate such a resounding success,” Ripley remarked about the bill’s passage. “It garnered substantial support, including 71 votes from Democrats. This is a clear sign of the executive branch beginning to soften its stance.”

Bipartisan Support for Crypto Regulation

The bipartisan nature of FIT21’s support is a significant development. It suggests a growing consensus among U.S. lawmakers about the importance of regulating the rapidly evolving cryptocurrency industry. This consensus marks a departure from the previously fragmented and often adversarial regulatory environment.

The FIT21 Act aims to address several critical issues facing the crypto industry, including consumer protection, anti-money laundering (AML) measures, and clear guidelines for digital asset trading platforms. By establishing a more predictable regulatory landscape, the bill seeks to foster innovation while ensuring that the risks associated with cryptocurrencies are managed effectively.

Former President Trump’s Evolving Crypto Views

Ripley also touched upon former President Donald Trump’s evolving stance on cryptocurrencies. Trump, who once labeled Bitcoin a “scam,” has shown signs of changing his views. In April 2023, Trump released a non-fungible token (NFT) collection and expressed support for cryptocurrencies in late May, as reported by The Block.

“Everyone embarks on a journey with Bitcoin and cryptocurrency, including myself,” Ripley said. “Trump’s recent comments indicate he might be on a learning journey about these technologies. When individuals take the time to understand Bitcoin and cryptocurrency, it often leads to a positive outcome.”

The Broader Implications for the Crypto Industry

Ripley’s observations highlight a broader trend within the U.S. political landscape. The increasing support for cryptocurrencies from both sides of the political spectrum suggests a maturing understanding of digital assets’ potential and risks. This shift could pave the way for more balanced and effective regulation, which is crucial for the industry’s long-term growth and stability.

Key Challenges and Opportunities Ahead

Despite the positive developments, the cryptocurrency industry still faces significant challenges. Regulatory uncertainty remains a major hurdle for businesses operating in this space. The lack of clear guidelines can lead to compliance difficulties and hinder innovation. However, the passage of FIT21 and the growing bipartisan support for crypto regulation are promising signs that these issues might be addressed soon.

Moreover, the industry must continue to engage with policymakers to ensure that future regulations strike the right balance between fostering innovation and protecting consumers. Companies like Kraken play a crucial role in this process by advocating for sensible regulation and educating lawmakers about the benefits and risks of cryptocurrencies.

Conclusion

The evolving stance of the Biden Administration towards cryptocurrencies, as highlighted by Kraken CEO Dave Ripley, is a promising development for the industry. The successful passage of the FIT21 Act and the growing bipartisan support indicate a more balanced and supportive regulatory environment is on the horizon. Additionally, former President Trump’s changing views on cryptocurrencies reflect a broader trend of increasing acceptance and understanding of digital assets among political leaders.

As the cryptocurrency industry continues to grow and mature, effective regulation will be key to ensuring its long-term success. By fostering innovation while addressing the associated risks, policymakers can help unlock the full potential of cryptocurrencies, benefiting both the industry and society at large.