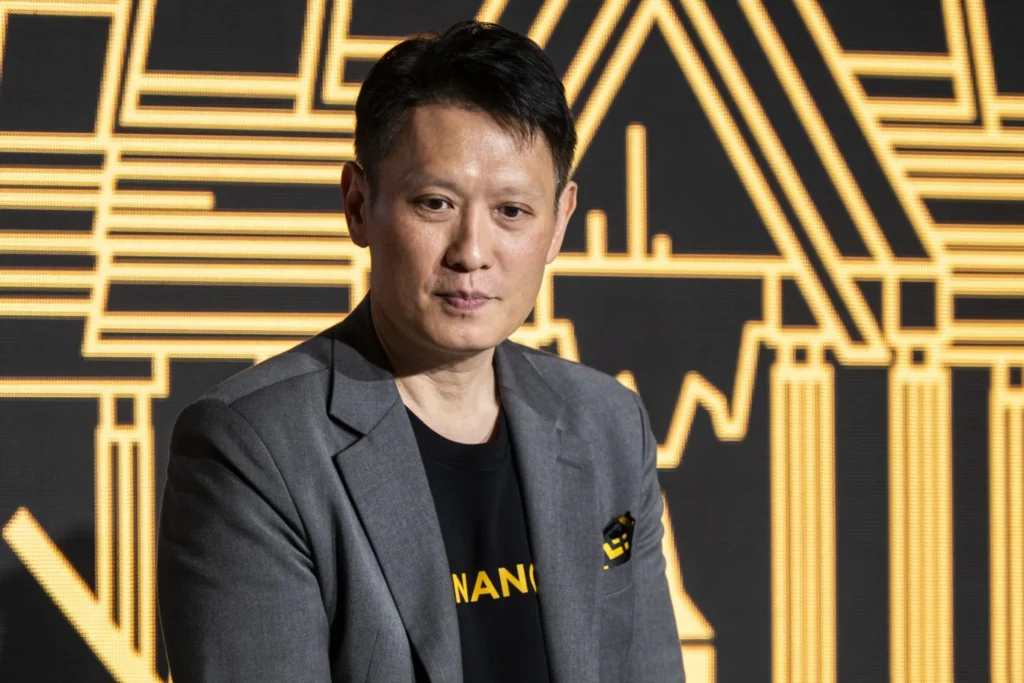

Binance CEO Richard Teng Predicts ‘Landmark’ Year as Crypto Goes Mainstream

QuickTake:

- Binance CEO Richard Teng describes 2024 as a pivotal year for the crypto industry.

- Regulatory clarity and mainstream adoption are key drivers.

- Binance’s customer assets grew by $42 billion in 2024.

- Binance now boasts 200 million registered users.

- Post-US settlement, Binance is under close monitorship.

- Customer exposure to bankrupt FlowBank is minimal.

2024 is shaping up to be a transformative year for the cryptocurrency industry, according to Richard Teng, CEO of Binance Holdings Ltd. In a recent interview, Teng highlighted the significant strides made by the sector, attributing this progress to increased regulatory clarity, wider mainstream adoption, and the introduction of exchange-traded funds (ETFs) linked to Bitcoin.

Binance, one of the leading cryptocurrency exchanges globally, has experienced substantial growth in 2024. The platform saw customer assets soar by $42 billion as the market rebounded, underscoring the renewed investor confidence in digital assets. Teng proudly announced that Binance reached a milestone of 200 million registered users this month. However, he did not disclose how many of these users are actively trading on the platform. A Binance spokesperson added that the number of monthly active users has seen a significant rise, reflecting the platform’s growing popularity.

The recent US settlement has placed Binance under strict monitorship, marking a new chapter in its regulatory journey. This oversight is a crucial development, ensuring that the exchange adheres to compliance standards and operates transparently within the legal framework. Teng emphasized the importance of this monitorship, suggesting that it would bolster investor trust and contribute to the platform’s long-term sustainability.

Teng described the year as a “landmark” for the crypto industry, noting that the evolving regulatory landscape has played a pivotal role in fostering a more secure and stable environment for digital assets. Regulatory clarity has been a long-standing challenge for the industry, often leading to uncertainty and hesitation among investors. However, recent advancements have begun to address these concerns, paving the way for more robust regulatory frameworks that can support the industry’s growth.

One of the significant highlights of this year has been the mainstream adoption of cryptocurrencies. Increasingly, traditional financial institutions and mainstream investors are recognizing the potential of digital assets, leading to greater integration of cryptocurrencies into the global financial system. The launch of Bitcoin ETFs has been a game-changer, providing investors with a more accessible and regulated way to gain exposure to the crypto market. This development has not only broadened the investor base but also contributed to the legitimization of cryptocurrencies as a viable asset class.

Binance’s impressive growth metrics reflect this broader industry trend. The surge in customer assets and the expanding user base underscore the platform’s strong market position and its ability to attract and retain investors. This growth is particularly noteworthy given the challenges the industry has faced, including market volatility and regulatory scrutiny.

In addition to the positive industry trends, Binance’s proactive approach to compliance and regulation has been instrumental in its success. The company’s commitment to adhering to regulatory requirements and fostering a secure trading environment has helped build investor confidence. Teng highlighted that Binance is continuously working to enhance its compliance measures, ensuring that it remains at the forefront of regulatory standards.

However, Teng also addressed some of the challenges facing the industry. One such issue is the bankruptcy of FlowBank, which has affected some customers. Teng reassured that customer exposure to FlowBank is minimal, with “very little assets” tied up in the bankrupt institution. This situation underscores the importance of regulatory oversight and the need for robust risk management practices within the industry.

Looking ahead, Teng is optimistic about the future of the crypto industry. He believes that continued regulatory advancements and growing mainstream acceptance will drive further growth and innovation. Binance is well-positioned to capitalize on these trends, with plans to expand its product offerings and enhance its platform capabilities.

Teng’s vision for the future includes a more integrated financial ecosystem where cryptocurrencies coexist with traditional financial instruments. He envisions a world where digital assets are seamlessly integrated into everyday financial activities, providing users with greater flexibility and control over their financial portfolios.

In conclusion, 2024 is proving to be a transformative year for the crypto industry, marked by significant growth and development. Binance, under the leadership of Richard Teng, is at the forefront of this evolution, driving innovation and setting new standards for the industry. As regulatory clarity improves and mainstream adoption continues to rise, the future of cryptocurrencies looks brighter than ever. With its strong market position and commitment to compliance, Binance is well-equipped to navigate the evolving landscape and capitalize on the opportunities ahead.