Crypto VCs Surge in 2023 with Multicoin Capital Leading the Pack

QUICK TAKE

- Top crypto venture-capital firms saw significant asset value increases in 2023.

- Multicoin Capital experienced the largest growth, with a 180% increase.

- The rise in VC assets paralleled the broader recovery in the crypto market.

In 2023, leading crypto venture-capital firms experienced a robust recovery, with notable increases in their asset values. Among these firms, Multicoin Capital emerged as a standout, showcasing a remarkable 180% surge in its portfolio. This upward trend reflects a broader resurgence in the cryptocurrency market, signaling a promising shift for investors and founders alike.

Venture capitalists play a crucial role in the crypto ecosystem, providing essential funding and support for innovative projects. According to recent filings with the Securities and Exchange Commission, several top crypto VCs reported substantial gains in 2023, following a challenging period in 2022.

Multicoin Capital, known for its strong connections with the Solana ecosystem, saw its assets’ value skyrocket from approximately $1.36 billion in 2022 to an impressive $3.81 billion in 2023. This 180% increase underscores the firm’s strategic investments and the overall recovery of the crypto market.

Polychain Capital, founded by former Coinbase employee Olaf Carlson-Wee, also reported significant growth. The value of its fund nearly doubled, rising from $2.61 billion in 2022 to $5.04 billion in 2023. This remarkable increase highlights Polychain’s ability to navigate the volatile crypto landscape effectively.

Blockchain Capital, which raised an additional $580 million for crypto investments in September 2023, saw its assets under management grow from almost $1.74 billion to $2.36 billion. This growth trajectory reflects the firm’s continued confidence in the potential of blockchain technology and its applications.

Other notable firms also reported asset value increases, albeit to a lesser extent. Paradigm’s fund value surpassed $10 billion, Haun Ventures valued its assets at over $1.5 billion, and Andreessen Horowitz’s extensive fund, which includes significant crypto investments, reached $56 billion by the end of 2023.

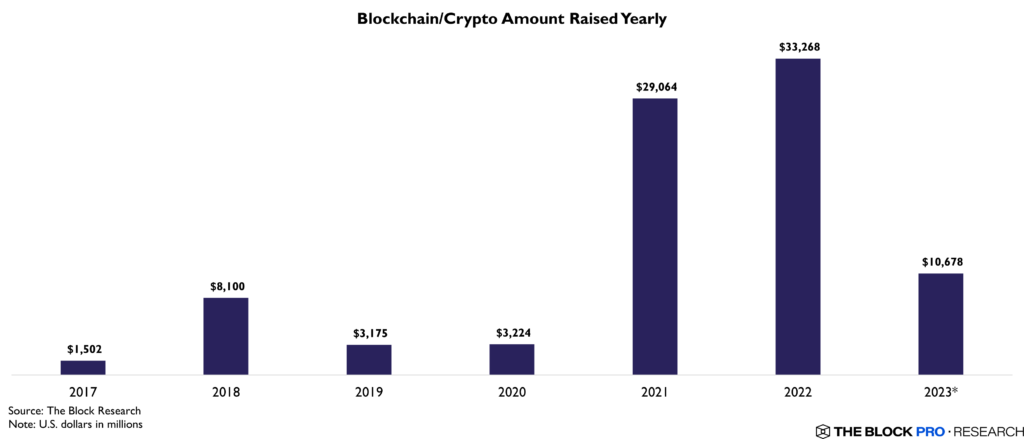

The resurgence in crypto venture-capital investments mirrors the broader revival of the crypto market. In 2022, many top crypto investors saw a sharp decline in their assets under management compared to the peak levels of 2021. For instance, Paradigm marked down its portfolio by 34%, while Multicoin Capital reported an 85% drop in asset value.

The total value of crypto raises also plummeted, hitting a monthly low of just under $300 million in July 2023, down from over $7 billion in October 2021, according to data from DefiLlama. However, the market has since rebounded significantly.

Bitcoin’s value reached an all-time high of over $71,000 in March 2023, according to CoinGecko, signaling renewed investor confidence in the market. In February 2023 alone, crypto VCs invested around $1 billion into the industry, highlighting a reinvigorated appetite for crypto investments.

Despite the resurgence, VC enthusiasm showed signs of tapering off later in the year, with May recording only about $200 million in raises. This indicates that while there is renewed optimism in the crypto industry, the market has not yet returned to the frenetic levels of the last bull market.

In comparison to the peak of 2021, some crypto VCs have not fully recovered. Paradigm, for instance, reported assets under management of $13.2 billion in 2021 and employed 73 staff members. As of 2023, the firm’s staff count had decreased to 59 employees, reflecting a more cautious approach amid ongoing market volatility.

The impressive recovery in 2023 underscores the resilience and adaptability of top crypto venture-capital firms. Their ability to bounce back from a challenging period highlights the dynamic nature of the crypto market and the potential for future growth and innovation.

Multicoin Capital’s outstanding 180% increase in asset value is a testament to its strategic investments and strong market positioning. This remarkable growth sets a high bar for other crypto VCs and underscores the firm’s pivotal role in the crypto ecosystem.

Polychain Capital and Blockchain Capital’s significant gains further illustrate the broad-based recovery across the crypto VC landscape. These firms’ ability to nearly double their assets under management reflects their successful navigation of the market’s ups and downs.

Looking ahead, the continued evolution of the crypto market will likely present both opportunities and challenges for venture capitalists. As the market matures, VCs will need to remain agile, identifying and capitalizing on emerging trends and technologies to sustain growth and drive innovation.

In conclusion, 2023 has proven to be a year of recovery and growth for top crypto venture-capital firms. The significant increases in asset values highlight the resilience and potential of the crypto market. As these firms continue to adapt and invest in innovative projects, they will play a crucial role in shaping the future of the cryptocurrency industry.