MicroStrategy Joins MSCI World Index: Crypto and Equity Convergence

Quick Take:

- MicroStrategy’s (MSTR) inclusion in the MSCI World Index reflects the growing prominence of crypto-related stocks in traditional equity markets.

- The move underscores MicroStrategy’s significant performance this year, outstripping Bitcoin gains.

- Analysts express caution, highlighting alternative routes for investors seeking exposure to Bitcoin.

MicroStrategy’s stock (MSTR) has recently made waves in traditional equity markets as it secures a coveted spot in the MSCI World Index, signaling the increasing integration of cryptocurrency-related assets into mainstream investment portfolios. The MSCI World Index, a renowned benchmark capturing the performance of large and mid-cap companies across 23 developed markets, now includes MicroStrategy, further legitimizing the role of cryptocurrencies in the global financial landscape.

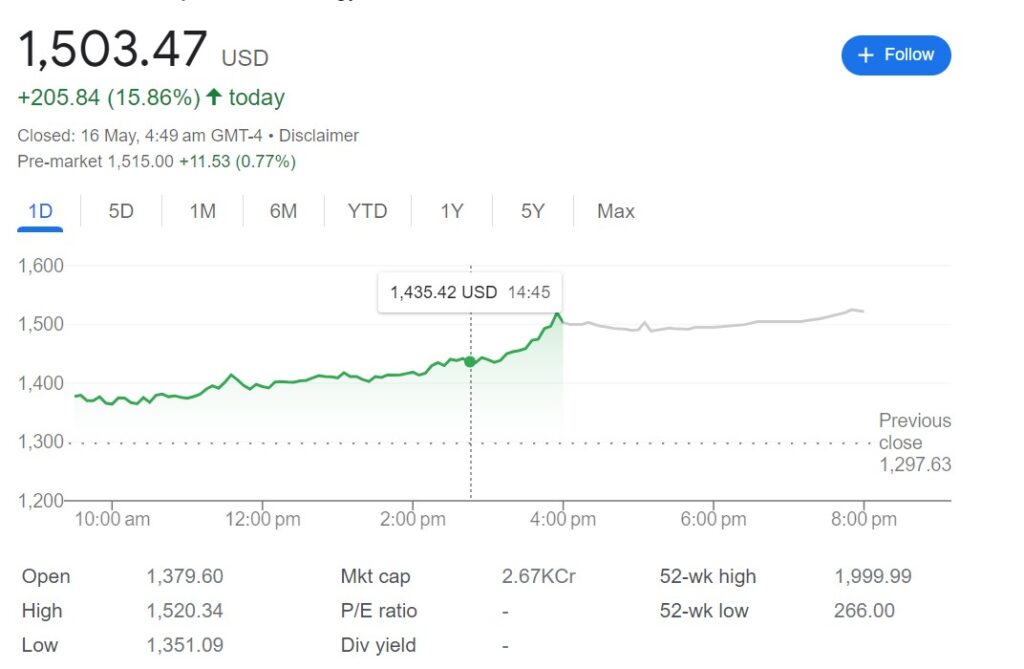

Since the beginning of the year, MicroStrategy’s stock has skyrocketed by more than 105.44%, far surpassing the gains witnessed in the volatile cryptocurrency market, particularly Bitcoin. This notable surge in MicroStrategy’s stock price has propelled its market capitalization to an impressive $23.02 billion, marking a remarkable achievement for the company. Despite its recent gains, MicroStrategy’s stock still lags behind its peak value of $1,919 in 2024, a testament to the inherent volatility of both equity and crypto markets.

MicroStrategy’s journey in the financial markets traces back to its founding in 1998, a period marked by the dot-com bubble that saw the company’s stock soaring to an all-time high of $3,130 before plummeting to just $5 within a year. However, under the leadership of CEO Michael Saylor, MicroStrategy experienced a resurgence, driven by a bold strategic shift towards embracing Bitcoin as a treasury reserve asset.

While MicroStrategy’s stellar performance may attract investors seeking exposure to the burgeoning crypto space, notable voices in the financial community, including renowned CNBC host Jim Cramer, caution against investing in the company’s stock. Cramer advises investors to consider alternative avenues for gaining exposure to Bitcoin directly, rather than through MicroStrategy’s stock.

As traditional equity indices incorporate crypto-related assets like MicroStrategy, the convergence between cryptocurrency and traditional finance accelerates, offering investors diversified opportunities to capitalize on the evolving financial landscape. However, prudent investment strategies and due diligence remain paramount in navigating the complexities of this rapidly evolving market landscape.